Bolstered Reserves: What North Carolina’s Rainy-Day Fund Means for 2023 Revenue Forecasting

The NC Chamber Foundation is driving a future-focused vision to expand economic growth and prosperity for all North Carolinians. Importantly, we continuously track and report on the latest data and trends on key issues facing our state.

As North Carolina enters another budget year, state policymakers are analyzing a wide array of economic factors, policies, and current spending to develop the biennium budget that guides the state. One such indicator of a healthy economy is the state’s ability to weather economic downturns, avoid cuts to critical services, and respond to emergencies with timely and adequate support.

In this month’s issue of Foundation Forecast, Dan Gerlach, economic advisor to the NC Chamber Foundation, provides insight on our state’s rainy-day funds and the growth trends over recent years.

We look forward to providing you with future insights on this and other issues related to the state’s competitiveness and long-term success.

Meredith Archie

President

NC Chamber Foundation

Bolstered Reserves: What North Carolina’s Rainy-Day Fund Means for 2023 Revenue Forecasting

In mid-February, the executive and legislative branches will issue a revised revenue forecast for the state government’s 2023-24 biennium. This forecast will be used by the Governor as a basis for budget recommendations, expected in mid-March.

Forecasting the state’s revenues from a complex and growing state economy is never easy and has become even more difficult since the advent of COVID-19. Projected record drops in revenue never materialized, as actual revenues soared. North Carolina’s revenue forecasts tend to be conservative to ensure that the state does not overcommit its resources to spending on state services, aid to local governments and nonprofits, or to tax relief. Concern about a pending economic slowdown, if not a recession, will weigh heavily on the minds of forecasters.

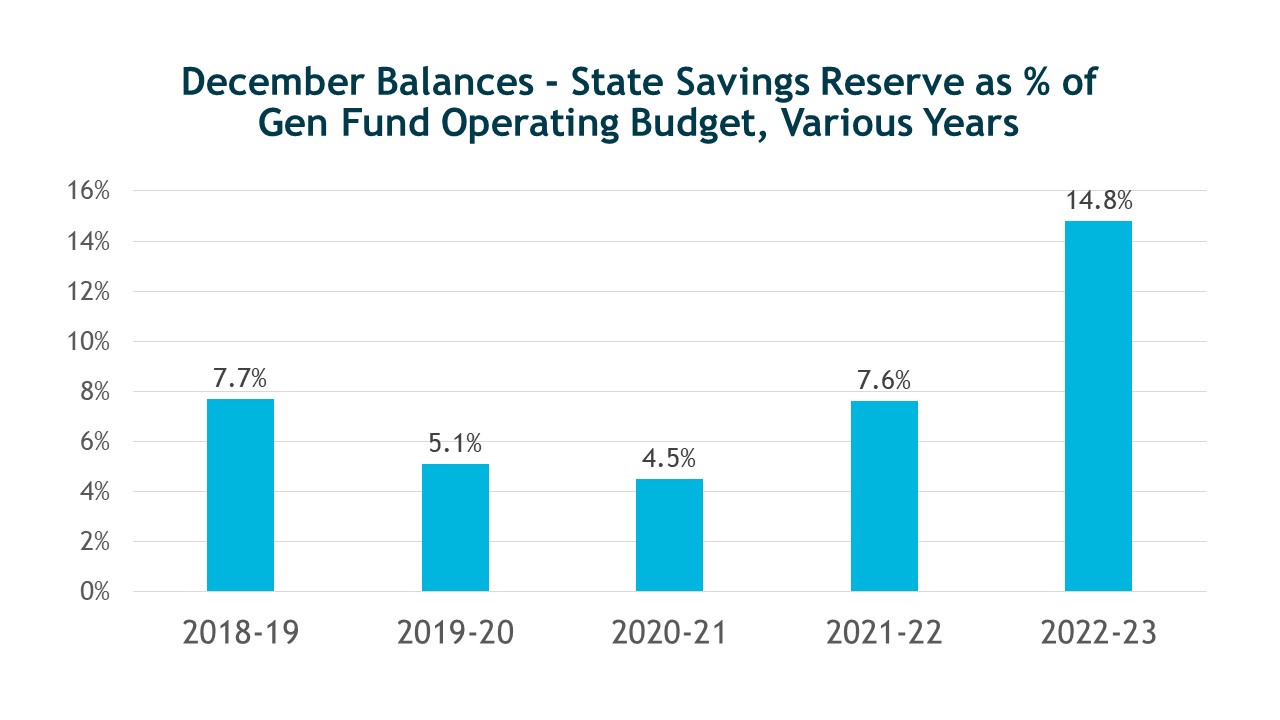

Yet the budgets enacted by the General Assembly in recent years to shore up state reserves and plan for inflationary times have given some cushion for forecasters to assess the relative conservatism of the revenue forecast. The State’s Savings Reserve, informally called the rainy-day fund, has doubled in size as percent of the state’s operating budget, as shown below.

Moreover, the General Assembly has taken other steps to mitigate challenges facing the state budget including the following:

- Establishment of a $1 billion Stabilization and Inflation Reserve to account for cost overruns due to inflationary forces for various state projects

- Addition of $1 billion to the State Emergency and Disaster Response Fund to address natural disaster emergencies and to take proactive steps to reduce the effects of future emergencies

- Provision of $326 million to a Medicaid Contingency Fund (in addition to a separate Medicaid Transformation Reserve) to fund unanticipated cost challenges to the state’s Medicaid program, given its entitlement status

These other reserves allow the state’s rainy-day fund to focus on its main mission: stabilizing revenues to guard against cuts in state spending to necessary state operations.

While many policy arguments are focused on the level of spending or the level of tax relief, the policy of building sufficient reserves with specified purposes rightfully builds more consensus and deserves recognition.