New Study Points to Urgent Need for Additional Transportation Revenue and Investments

In the past two years, the NC Chamber Foundation’s research was leveraged to secure $90 million in new annual state transportation revenue in 2021 and to allocate a percentage of the total sales tax collected for transfer from the state’s General Fund to the Highway Fund and the Highway Trust Fund in 2022. However, North Carolina is still significantly more dependent on the motor fuels tax than other states and we cannot afford to slow down efforts to improve its infrastructure.

More work is needed to create sustainable transportation funding for North Carolina, and data is essential to informing the solutions. Released last week, TRIP’s “Moving North Carolina Forward” report examines the condition, use, safety, and efficiency of North Carolina’s surface transportation system and the impact of additional transportation funding.

We worked with Dan Gerlach, economic advisor to the NC Chamber Foundation, on this month’s Foundation Forecast, which looks at this new data on the condition and funding of our state’s transportation network.

Meredith Archie

President

NC Chamber Foundation

New Study Points to Urgent Need for Additional Transportation Revenue and Investments

Infrastructure competitiveness is one of the NC Chamber Foundation’s three pillars of work that has informed generational transportation funding reforms. Despite historic bipartisan investments in our transportation system last year, the “Good Roads” state still has much work to do to be truly competitive long-term.

Recent analysis reveals that North Carolina road conditions need improvement and that the failure to improve transportation outcomes has negative fiscal effects on our citizens. Specifically, only 44 percent of the roads in our state are estimated to be in good or better condition. The remaining 56 percent are rated poor, mediocre, or fair.

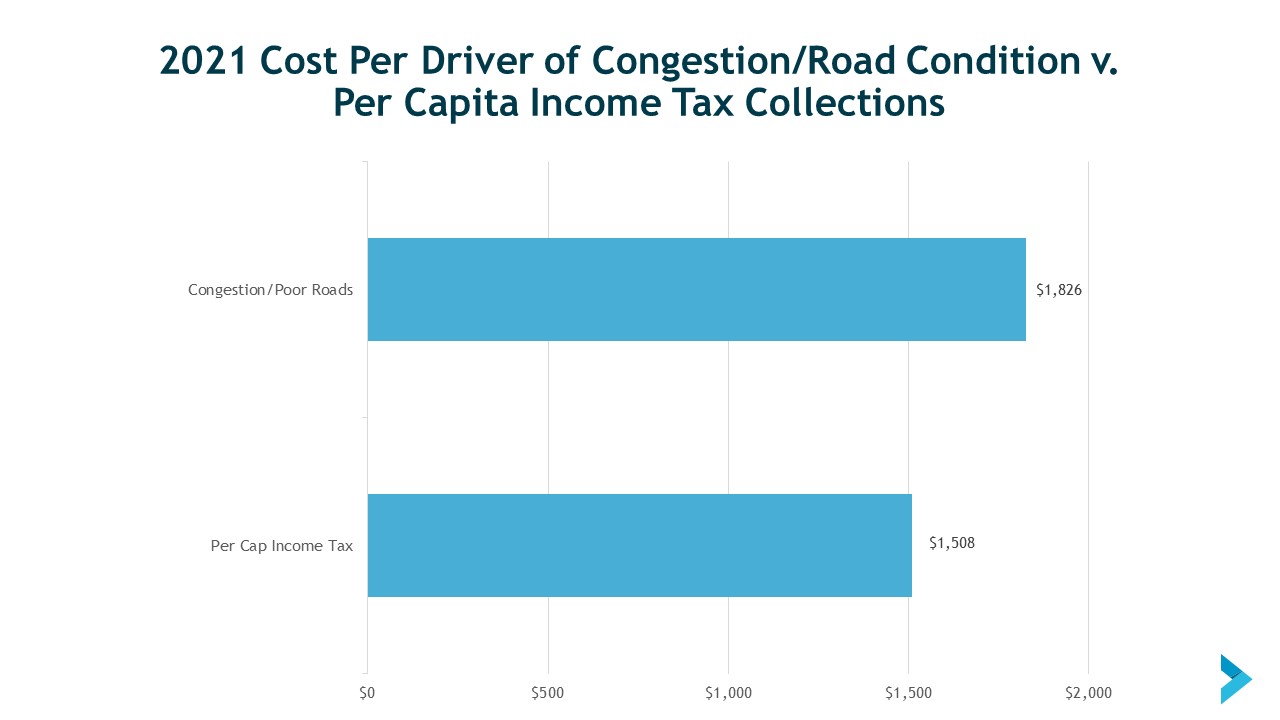

Unsatisfactory road conditions cost drivers in our state an average of $484 per year, totaling $3.7 billion annually. The cost of traffic congestion across the state varies but reaches a high of $1,342 per driver in the Charlotte metropolitan area. That’s a total annual cost of $1,826 per driver – more than the per capita collection of the state income tax.

A little-recognized provision in the 2023-25 budget legislation approved by the N.C. House of Representatives would help address some of these challenges. The legislation would provide $500 million per year for each of the following two years to add to the current state budget for road maintenance. This action comes in addition to last year’s budget legislation to eventually shift six percent of the state’s general sales tax (roughly $600 million per year) to support road construction, maintenance, and other transportation needs.

The North Carolina Senate has introduced legislation, currently pending in its Finance Committee, to increase revenue availability for transportation as well.

While funding support has increased, so too has the cost of building and maintaining this crucial infrastructure. Between January 2021 and June 2022, the Federal Highway Administration estimates that the cost of construction increased 37 percent.

The NC Chamber Foundation’s work to research, benchmark, and identify revenue streams that will, unlike the gas tax, grow with the economy, is incredibly important for North Carolina to maintain the infrastructure necessary for our growing state. Cars continue to be more fuel-efficient, reducing the number of gallons purchased and thus also reducing gas tax revenue. Moreover, electric vehicle sales are expected to reach 60 percent of passenger car sales by 2040 and represent 30 percent of the total vehicle fleet, also reducing gas dependence and motor fuel taxes.

The NC Chamber Foundation remains focused on infrastructure as a key pillar of its work for this very reason.