Monitoring North Carolina’s Tax Policy Competitiveness

While North Carolina consistently ranks as a top state for business, we can’t become complacent. The NC Chamber Foundation conducts policy research and consistently monitors indicators of competitiveness to ensure the state is well-positioned for economic growth and job creation. Tax policy is one of these driving factors.

We worked with Dan Gerlach, economic advisor to the NC Chamber Foundation, on this month’s Foundation Forecast, which tracks the impacts of recent tax reform and reports how the state’s tax climate is benchmarking nationally.

Meredith Archie

President

NC Chamber Foundation

Monitoring North Carolina’s Tax Policy Competitiveness

A Foundation Forecast published in June of 2022 reviewed the effects of the past ten years of tax reform, both in terms of tax burden (how much is paid) and tax structure (how government collects its funds). That forecast examined changes in tax collection, taxes as a share of the economy, and taxes compared to spending patterns.

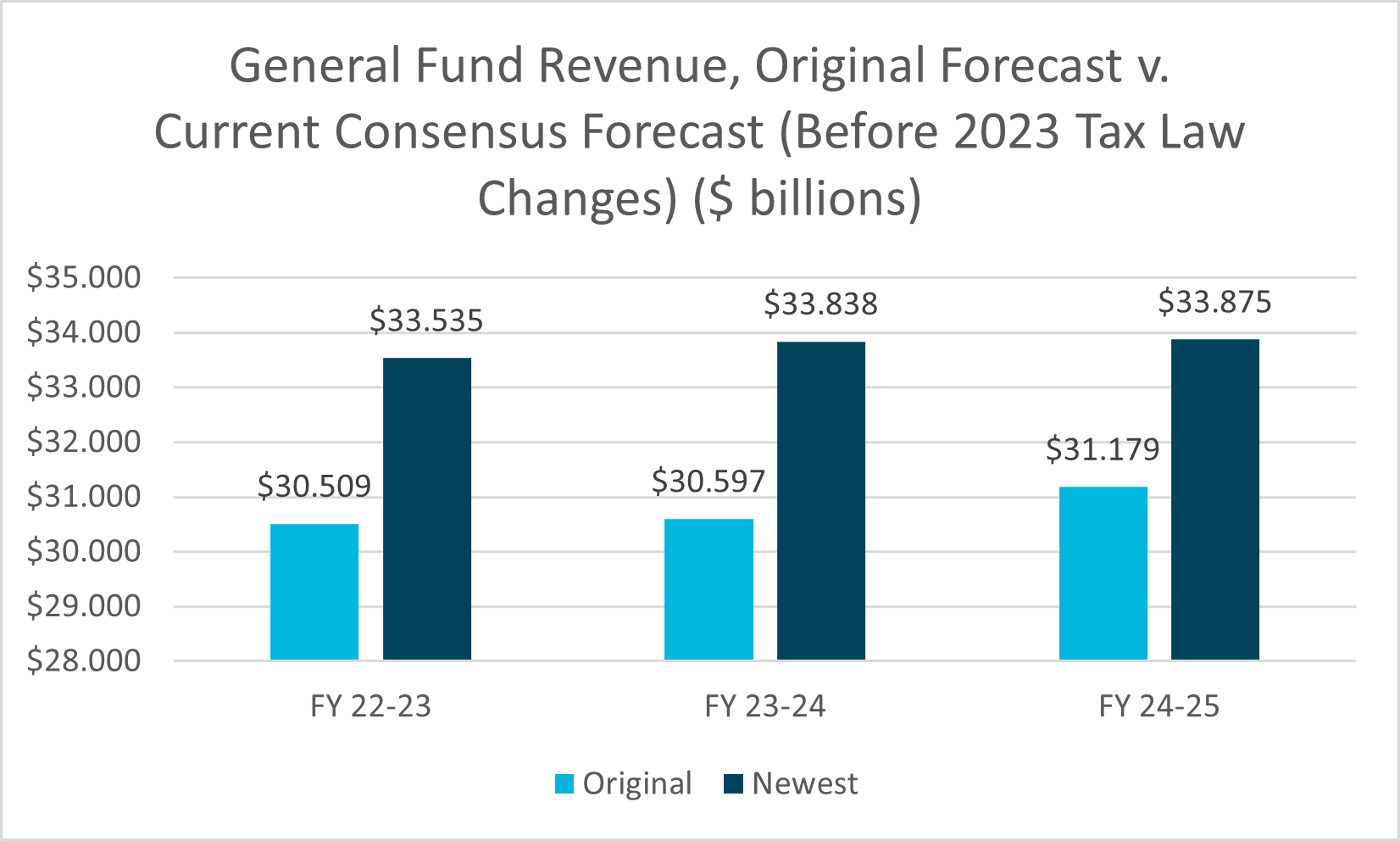

North Carolina continued to collect more in tax revenue than was anticipated, as shown below.i

This is important because, in 2024, the state’s personal income tax rate will decline to 4.5%, with further reductions scheduled. This is in addition to the phaseout of our corporate income tax, which begins in earnest in 2025.

Not only has the tax burden changed, but the structure has become more favorable, putting more emphasis on broader tax bases and lower tax rates. The Tax Foundation notes that North Carolina has reduced its corporate income tax component from 26th in 2014 to 5th in 2024.

Similarly, our Tax Foundation ranking on the individual income tax has improved from 37th in 2014 to 17th today. Overall, North Carolina’s business tax climate ranks 9th best in the nation.ii

Despite these tax changes, North Carolina’s ability to pay for needed government services has not been negatively affected. North Carolina revenues for 2024-25 (with tax cuts accounted for) are expected to be $33.365 billion, compared to the state operating budget for that year of $30.902 billion, resulting in a surplus of $2.46 billion.iii

General Fund appropriations also increased from $27.902 billion in 2022-23 to $29.787 billion in 2023-24, a 6.75% increase.iv And still there are funds for these one-time uses.

This surplus exists even after the General Assembly authorized the transfer of sales tax revenues that previously went to the state general fund to the state’s highway and highway trust funds to enable improvements to North Carolina transportation infrastructure, a pro-growth move.

While businesses hope for additional reforms, notably in the state franchise tax, our state leaders have improved tax fairness and competitiveness, contributing to our longstanding reputation as a great state for economic growth and prosperity.

iOriginal forecast are taken from https://www.nctreasurer.com/documents/files/slgdaacanddebt/debt-affordability-study-2023/download?attachment, table 10 and the current forecast are based on actual year-end numbers published by the Office of State Budget and Management and included in the state budget availability statement as the Revised Consensus Revenue Forecast.

iihttps://taxfoundation.org/wp-content/uploads/2023/10/2024-State-Business-Tax-Climate-Index-1.pdf

iiihttps://webservices.ncleg.gov/ViewNewsFile/81/CommitteeReport_2023_09_20_Final, calculations based on p. 7.

ivAuthor’s calculations based on the Net General Fund Availability Statement in the legislative budget conference reports, various years.