Assessing the Impact of Tax Reforms

Your NC Chamber Foundation is focused on a prosperous, competitive, and healthy future – providing research and policy recommendations that have been leveraged to advocate for fundamental reforms. Another key part of that effort is tracking our state’s progress and understanding if policy changes result in economic growth and prosperity for North Carolinians.

Tax policy is often noted as a driving factor of competitiveness. As the NC Chamber continues to pursue tax policy improvements that invite an ever-greater diversity of businesses and top-level talent to our state, it also remains focused on protecting the competitive gains we’ve already made to keep our state improving in the face of a constantly shifting nationwide tax landscape.

We worked with Dan Gerlach, economic advisor to the NC Chamber Foundation, on this month’s Foundation Forecast, which looks at how our state has been impacted by tax reform over the last decade. Are the critics right, does our state have less to invest in critical systems and infrastructures? Or have these reforms helped bring growth and increased investment? Moreover, how do we stack up against other states?

Making North Carolina the best place in the world to live, work, learn, and do business is no easy feat, but our state has made phenomenal strides over the last few years toward that goal. The data is clear: competitive tax policy is a key part of the recipe for success.

Meredith Archie

President

NC Chamber Foundation

Assessing the Impact of Tax Reforms

The NC Chamber has long championed and applauded the N.C. General Assembly’s efforts to reform the state’s tax structure over the last decade. The Tax Foundation now ranks North Carolina’s business tax climate as 11th best in the nation, a significant change from the ranking of 31st in 2014.

Moreover, a decade of data shows that these changes did reduce the tax burden as a share of the economy but did so without significant changes in revenue growth trends, without shifting the burden to local governments, and, presumably, without risking significant structural budget deficits in the future.

Tax policy experts generally agree that the best tax system is one that uses broad bases of economic activity and as low rates as feasible to generate the revenue government reasonably needs to function. Since 2013, the General Assembly has enacted substantial changes in North Carolina’s tax system, including marked reductions and flattening of marginal rates. The goals of these changes have been to promote (or not impede) economic growth and success, increase fairness by treating taxpayers with similar incomes or consumption patterns similarly, and to reduce the burden on taxpayers.

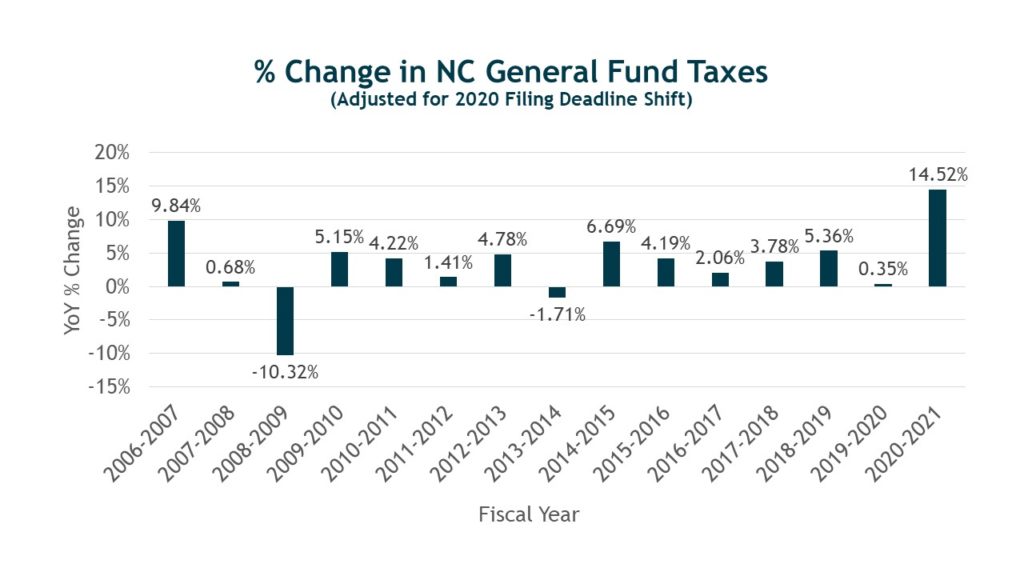

As with any changes, there are criticisms. One is that taxes have been cut too much, jeopardizing needed government spending. Here’s the latest data from the N.C. Department of Revenue, which shows that General Fund revenues have not fallen off the cliff.

If we take 2013 as a breakpoint, we do see one year of General Fund tax collection decline in 2013-14, followed by a strong recovery in the following year and fairly moderate outcomes thereafter.

We adjust the 2019-2020 and 2020-21 tax revenues to account for the shift in filing deadlines from April 2020 to July 2020, but obviously last year was very strong and FY 2022 will be the same.

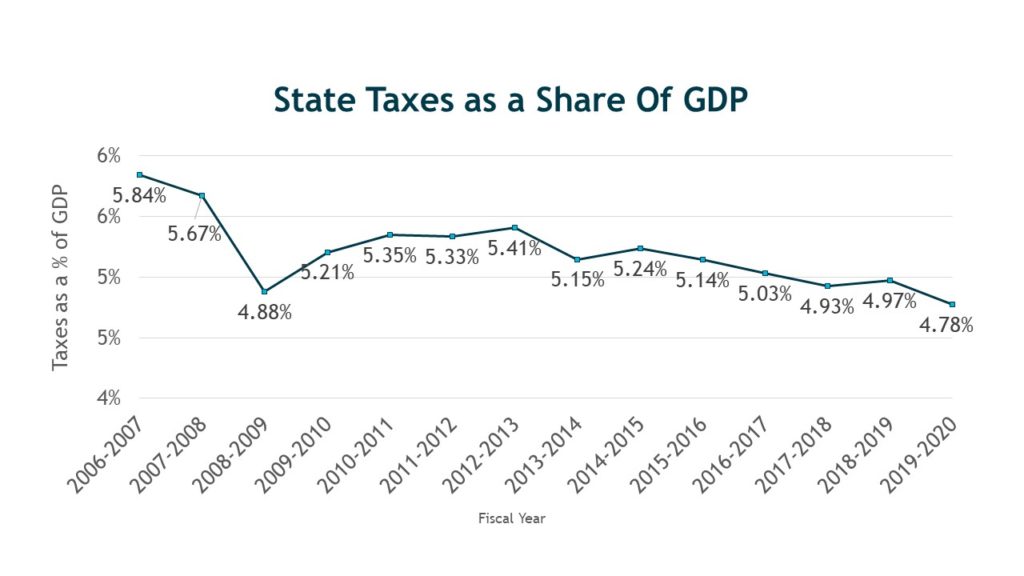

That said, through FY 2020, state taxes as a percent of the state’s economy have decreased, indicating indicating a reduction of burden on North Carolina taxpayers.

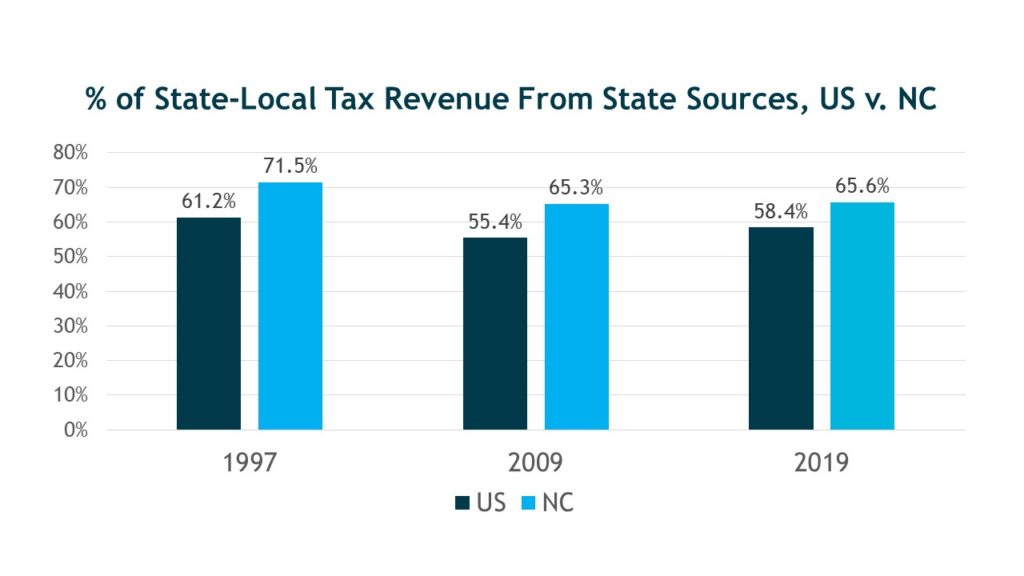

Another criticism might be that as the state has reformed its tax system, the burden might fall more to local governments. According to 2019 data, the latest available from the U.S. Census Bureau, North Carolina’s state share of state-local tax revenues remains at the same percentage (65 percent) as it did in 2009. Other states have increased their shares over that time frame, but North Carolina remains more state-focused than the national average.

Another criticism might be that as the state has reformed its tax system, the burden might fall more to local governments. According to 2019 data, the latest available from the U.S. Census Bureau, North Carolina’s state share of state-local tax revenues remains at the same percentage (65 percent) as it did in 2009. Other states have increased their shares over that time frame, but North Carolina remains more state-focused than the national average.

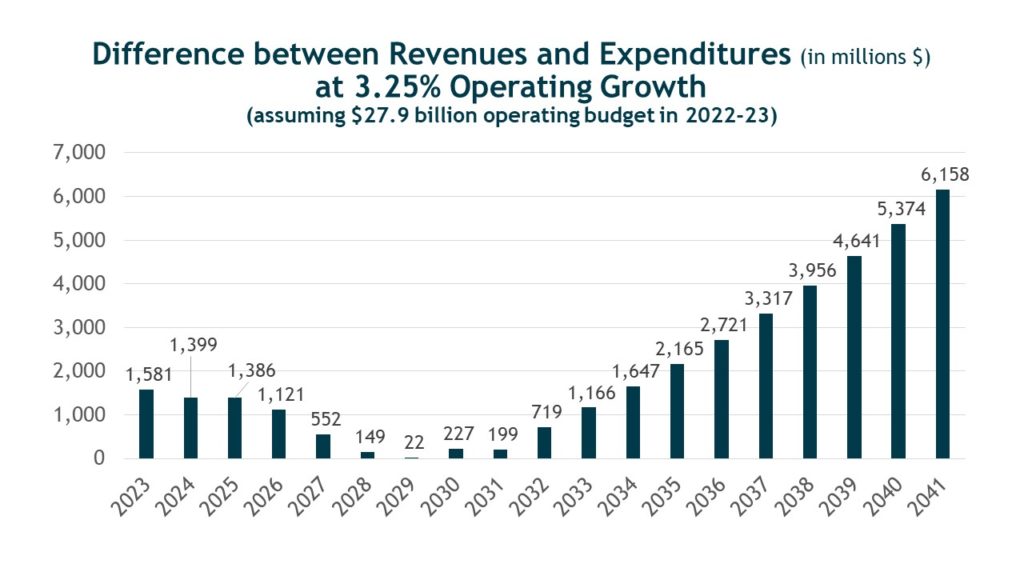

But the argument about sufficiency continues. While previous General Assembly tax actions include broadening the bases of our taxes in addition to cutting rates, the actions taken last November were primarily to reform bases (franchise tax) and reduce rates (individual and corporate income tax). So, will the state have enough money? Frankly, it depends on your views on spending.

Let’s assume the following:

- State revenues grow at the rate used in the Treasurer’s Debt Affordability Study,

- General Fund operating spending by the General Assembly is appropriated at $27.9 billion for fiscal year 2022-23,

- State operating spending grows by 3.25 percent over time.

The results show significant tightening in future years as the tax cuts are phased in, but that the forecast does not go negative (while reality will not work out in exactly this way, this hypothetical gives a sense of the General Assembly’s rationale). Of course, others might argue that spending needs to be higher this year and in future years.

Ultimately, tax policy is one lever in a series that can be pulled to affect our state’s competitiveness. Continued investment in talent pipelines and infrastructure are also key issues that help North Carolina remain the best place in the world to live, work, learn, play, and do business. Your NC Chamber Foundation will continue to measure the impact of these balanced policy reforms as we continue to forecast a competitive future.

Don’t miss additional updates, studies, and initiatives from the NC Chamber Foundation. Sign up to receive NC Chamber Foundation updates below.